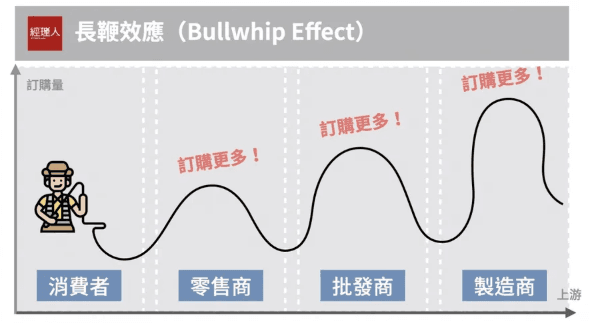

Paper Discussion: Governance Failure Caused by the Bullwhip Effect

(This article mainly discusses the governance failure in manufacturing supply chains caused by the bullwhip effect, as explored in The Bullwhip Effect in SC by Hau L. Lee, V. Padmanabhan, and Seungjin Whang.)

When Supply Chain Issues Are No Longer Just Forecast Errors, But Complete Distortion of Organizational Decisions

(Image source: Manager Today)

When most companies discuss the bullwhip effect, their initial reaction often remains at "inaccurate demand forecasting" or "too much or too little inventory." However, after my actual observations of numerous manufacturing and supply chain sites, combined with theoretical studies, a more dangerous conclusion has gradually emerged:

What the bullwhip effect truly damages is not just operational efficiency, but the very governance capability of the enterprise.

When information is repeatedly distorted between organizations, every seemingly rational decision made by management is actually based on a false perception of reality. This is no longer an optimization problem; it is a governance failure.

The Tipping Point from Information Distortion to Governance Failure

Theoretically, the bullwhip effect describes the phenomenon of demand signals amplifying along the supply chain. However, in practice, it manifests in a more brutal way:

-

The frontline sees "orders skyrocketing or disappearing"

-

Middle management sees "extremely unstable demand"

-

Senior management sees "the market suddenly becoming unpredictable"

Consequently, companies initiate a series of "seemingly correct" governance actions:

-

Demanding higher safety stock

-

Increasing approval layers to control procurement

-

Extending forecast cycles, attempting to flatten volatility

-

Using KPIs to pressure sales and suppliers to "report more accurately"

The problem is that, all these governance actions are built upon already distorted information.

The result is not stability, but a further amplification of distortion.

Why the Bullwhip Effect Inevitably Evolves into a Governance Problem

The reason the bullwhip effect evolves into governance failure is not due to a lack of intelligence, but rather three structural problems:

1. Information is not flowing; it is being "rewritten"

In most manufacturing environments, the path of demand information transmission is as follows:

Customer Email → Sales manual interpretation → Excel → ERP → Procurement and Production

Each node is not merely relaying information, but reinterpreting it. Delivery anxiety, fear of material shortages, and performance pressure are all "reasonably" added during this process.

What ultimately enters the system is no longer market demand, but the crystallization of organizational fears.

2. Governance Systems Can Only Manage Numbers, But Cannot See Distortion

The board and senior management see orders, forecasts, and inventory turnover in the ERP.

But the system never tells you:

-

Which orders were placed early to reserve capacity

-

Which demands were inflated due to fear of stockouts

-

Which cancellations could actually have been anticipated weeks ago

Governance sees the outcome, but not the distorted process that forms the outcome.

This forces management to react to symptoms rather than address the root cause.

3. Individual Rationality, When Superimposed, Creates Systemic Irrationality

For a single department:

-

Reporting slightly more demand is self-preservation

-

Pulling materials early is being responsible

-

Conservative forecasting is to avoid accountability

However, when everyone makes the same "rational" choices, the entire system gravitates towards extreme volatility.

The reason governance fails here is simple: No single role is accountable for the overall distortion.

Insight: What I See Is Not the Bullwhip Effect, But a Governance Fault Line

In many companies, the real problems often occur "before the formal system."

It's not that the ERP is not powerful enough; it's that the information it receives is already contaminated.

Common phenomena include:

-

Critical orders are hidden in email attachments and conversations

-

Sales and procurement each have their "privately understood versions"

-

System data is always slower than the real-world status

-

Management can only conduct post-mortem reviews, unable to intervene proactively

These are not operational issues, but a lack of governance vision.

When companies cannot promptly see how demand is being distorted, any governance system can only stray further and further on a wrong map.

Truly Effective Governance is Not About Suppressing Forecasts, But Suppressing Distortion

Many companies try to "calculate more accurately" using AI, advanced algorithms, and more reports.

But if the input itself is distorted, models will only amplify errors more precisely.

Truly effective governance should return to three core questions:

-

At which node does demand begin to be rewritten?

-

Which decisions are based on fear rather than actual consumption?

-

Can management see these deviations in real-time, instead of through post-hoc KPIs?

This is why the first step in managing the bullwhip effect is never a forecasting model, but rather the reconstruction of information structure.

The Bullwhip Effect is a Governance's Revealing Mirror

The reason the bullwhip effect repeatedly occurs is not because managers are not working hard enough, but because it reveals:

Most companies' governance systems are not built upon real demand.

When information is distorted layer by layer, governance devolves from a "decision-making system" into a "post-hoc rationalization tool."

The bullwhip effect is not a side effect of the supply chain, but a revealing mirror. What it reflects is not just inventory and delivery issues, but whether the enterprise truly possesses the ability to grasp reality.

If you are experiencing severe demand fluctuations, forecasts that constantly lag behind reality, and a significant disconnect between decision-makers and the frontline, then the problem likely lies not with the market, but with governance itself.

This is also the true risk that most companies have not yet recognized.